Higher-quality tools can lower project labor costs

The processes used for polishing concrete are quite possibly the most misunderstood piece of the business. A tremendous amount of sales propaganda is available that can either provide some clarity or add serious confusion. Most of this information comes from a wide range of “manufacturers” in the industry that number so many it’s hard to easily separate them. This is especially true with concrete polishing abrasives.

The cost of the grinding and abrasive pads, which I will refer to as tooling, is a large part of the cost to complete any project. Whether you’re an experienced contractor, a newcomer or a customer I hope you’ll gain some valuable knowledge from this article.

Grit size

Let’s start with the types of tooling and their uses. We will begin with the grit size from the most aggressive to the least aggressive options. The larger the particulate size, the more aggressive the tooling. Most of this tooling uses diamond pieces to grind or cut concrete. Based on the size of the particulate, there are several different matrix types that hold the diamond pieces.

The more aggressive larger diamond pieces are suspended in soft metals. As these tools move across the floor, the metal wears away at a measured rate. This allows for diamond pieces to continually become exposed. The diamond does the actual work. Metal is necessary because it must have a firm hold on the particulates so they can do their job of cutting.

If a large diamond piece is held in an extremely soft matrix, the pressure quickly pulls it out of suspension. This doesn’t allow it to cut the concrete. The grit number is based on size. With diamond tooling, the grit numbers are actually ranges and they relate to the size of the screen that holds a particular piece of diamond.

Imagine a silo, a tall round structure that typically stores grain. In this silo, cleaned and dried industrial-grade diamonds are blown in from the top. As they settle, imagine screens with varying-sized mesh inserted at different levels. The larger the hole size, the smaller the number associated with it. So, a 25-grit screen has openings four times as large as a 100-grit screen.

The smaller diamond pieces fall toward the bottom and the larger pieces stay closer to the top. This is how diamonds are sized. So, 25-grit diamonds are pretty large while 3,000-grit are extremely fine pieces of diamond particulates, practically diamond dust.

Matrix varieties

Typically, lower-grit diamonds are referred to as “metal bonds” since the diamond chunks are suspended in a shaped-metal piece. The higher-grit diamonds are generally referred to as “resin bonds” since the diamond dust is suspended in a shaped-resin matrix.

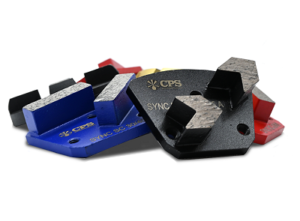

These two types of matrixes have changed shape a lot over the years based on new understandings of how concrete can be cut and what is left behind after each tool is used. When I first started in the business, all metal tooling was shaped with two rectangles attached to a backer plate (see page 48, lower left).

Over time, contractors and manufacturers figured out that if they rounded the edges the metal itself wouldn’t cause so many scratches (see page 48, top).

Resins used to all be held in round plastic cylinders. The industry now calls these “finger style” since the pieces are about the size of the end of a finger (top right). With this type, the plastic that held the resin in place would sometimes heat up too much and leave scratches in the floor that had to be worked out by going backwards. Some manufacturers perfected the plastic so this issue doesn’t occur. Over time most of the resin tooling has changed to one solid piece of formed resin. This type of tooling is typically referred to as “puck style” because they resemble hockey pucks (below).

Transititonals

Most of the industry’s recent changes have focused on tooling called “transitionals,” which are made of either a combination of metal and resin or out of another material. For instance, a few years ago Diamatic, one of the larger manufacturers, introduced a transitional made of porcelain (an entirely new material to this industry) that has performed extremely well (see page 50, bottom left).

Transitionals are used to remove polishing steps. Typically running one step of transitionals removes the need to run one step of metal-bond and one step of resin-bond tooling. So, they’re a two-for-one trade. They lower the total tooling cost as well as the labor cost. Labor overall makes up about 50 percent of the costs on decorative concrete projects. The tooling alone is generally 20 to 25 percent of the total costs.

Quantity matters

Manufacturers use grit size to sell their tooling. The larger pieces (with smaller numbers) are sold for grinding, removing existing coating or prepping floors. The finer grits (with higher numbers) are sold to polish and bring up gloss. Probably the single-most important thing to understand is that tooling is sold by the size of the particulate, not the amount of particulate. This small — but very important difference — separates manufacturers.

Most contractors don’t know or don’t think about this significant difference. For example, a good, high-quality manufacturer may use one tablespoon of 40-grit diamond pieces in its tooling. A low-quality manufacturer might use one teaspoon of 40 grit-pieces. Both manufacturers will then sell that tooling as 40-grit segments. Because both are using the same-size particulates, they don’t differentiate in their marketing yet the product difference is massive. The tooling with the higher diamond content will cut significantly better than the tooling with less.

I regularly talk with contractors when they have issues on projects. When we discuss tooling, I ask them what manufacturer they’re using. If I haven’t heard of the company, I ask why they chose that particular brand. More often than not, they say their regular manufacturer was too expensive and this new one is selling the same tooling for half the price. To that I say: The quality of the tooling makes all the difference and is naturally reflected in the cost.

Quality matters, too

In the concrete market today, very few manufacturers directly make the tooling they sell. Most find a company that will custom make the tooling based on their requirements. Known as private labeling, this is not necessarily a bad thing and is common throughout the industry.

Today the United States and Europe manufacture the highest-quality tooling, but Asia produces the majority of tooling. The Asian markets, especially South Korea and China, make tooling so cheap it’s almost impossible to compete without it. One manufacturer I talked with told me Asian markets routinely offer tooling at a third to a quarter the price of European or American tooling.

Asians have significantly upped their quality over the last five to 10 years, but there’s still very little quality control. I’m regularly on projects where brand new tooling will have flaws that cause major scratching that sometimes takes hours to work out, a situation many contractors have come to expect. It’s a clear tradeoff for lower-cost tooling.

Everyone wants/needs to offer competitive pricing for the bulk of the tooling lines and using manufacturers with lower prices but also lower quality control is how that’s accomplished. It’s cheaper for manufacturers to regularly send out replacement tooling at no additional cost than to pay for a higher-quality product on the front end. Effective marketing outside of the Asian markets generally includes very specialized tooling.

Contractors are willing to pay a large premium for these high-quality tools.

A similar decision has been made on the difference between actual diamond particulates and synthetic diamonds. Synthetic diamonds don’t cut as well, but the cost offset has forced most of the industry to use synthetic lab-grown diamonds for its tooling. Essentially well-made tooling with real diamonds and high-quality standards cost too much for the ever-tightening margins in the flooring industry to sustain. Manufacturers have just adjusted their sourcing and manufacturing partners to match the pricing requests of their customers and their competitors.

Hard versus soft

Another often misunderstood aspect of the tooling market is the relation of hard or soft concrete to hard or soft tooling. Every concrete slab is different and a lot of variables lead to these differences. Concrete mix designs are contributing factors with the ratios of cement, fly ash, sand, rock and other additives affecting the overall hardness.

The finishing process also greatly affects the hardness. If you finish a slab tightly, the gradation of the concrete particles is tight and dense, which makes for a hard surface. Compare this to wood. If the concrete is soft and porous, it’s similar to pine which is softer and easier to dent, scratch or wear away. If the concrete is dense and hard, it’s similar to oak or walnut with a very tight grain that’s hard to cut or scratch.

Hard concrete

When the concrete is hard, it takes a lot more diamond particulates to cut it. The diamond is harder than the concrete without question. Where the issue comes in, however, is the delivery of that diamond particulate to the concrete surface. Generally, when discussing hard or soft tooling, we concentrate on the metal bonds. By the time you reach the higher-grit resin-bond diamonds, the floor has opened up so there isn’t a problem. If the metal that holds the larger diamond chunks is hard and the concrete is hard, the metal will not wear away at a rate that will allow the diamond to remain in contact with the concrete. So for hard concrete, using softer metal matrixes is key.

Soft concrete

The opposite is true for softer concrete. If you use a soft metal on soft concrete, the metal will wear away very quickly. I didn’t understand this relationship when I was just starting out as a contractor working on a school project that involved a 5,000-square-foot cafeteria. The concrete was soft, but I didn’t know that.

We started with a 40-grit diamond and I had bought five sets of tooling which should have been enough to grind the whole 40,000-square-foot school. After about an hour, the crew told me we needed to order more diamonds. They had used all five sets on the first 2,000 square feet. Very expensive tooling that had a rating to last 8,000 to 10,000 square feet per set only lasted 400 to 500 square feet. I went ballistic and was upset because my crew didn’t stop and try to figure out why we were going through tooling so fast. This was an expensive learning experience for all of us.

Learning on the job site

I remember another job where we went through a set of 25-grit diamonds in 30 feet on the first pass. The machine started prepping for the sample area and very quickly we heard a grinding noise that didn’t sound right. When we lifted the machine, the diamonds had worn down to the plates.

I have had just as many projects where the tooling was too hard and the concrete would not cut. The hard tooling just bounces on top of the hard slab. Then the metal heats up and covers the diamonds. The industry usually refers to this as “glazing over” or “glazed up.”

These are just a few examples of what you can run into if you’re not using a tooling matrix to match the hardness of your concrete.

There are many ways to tell if your concrete is hard or soft. The most common method is to use a Mohs hardness test using small picks. Do this test at the beginning of the job or preferably before it starts. Based on the results of your scratch test, you can order tooling that best fits the project.

Choose wisely

There is no standard or governing body that sets specific testing points on tooling. Sometimes that makes it hard to separate the good from the bad. With so many manufacturers pushing their systems, there are a lot of both in the marketplace.

As a contractor, the basis of my supplier selection was field testing. I figured all manufacturers are in business to make a profit, so they work to achieve the lowest cost tooling that will provide the standard of cut to meet their customer’s requirements. Now, remember what I said at the beginning of this article about most manufacturers using a third party to make tooling to their specifications. I figured each of those manufacturing plants are also in business to make money.

So what happens is ABC manufacturer contracts with DEF manufacturing plant to have the tooling made. ABC provides a list of standard product points — such as size, shape and amount of particulate — and DEF fills these orders. The product works fantastically well. But DEF is trying to eke out as much profit as it can as well so it subtly changes the tooling. It may use a slightly different and cheaper metal or resin. It may change the diamond particulate supplier to one that’s a bit cheaper. These small changes still meet ABC’s contract requirements so everything is good.

Meanwhile, in the field, the tooling that was cutting really well last month is a bit off this month. In this way, the manufacturer’s quality levels are changing constantly. So testing was a big part of determining our tooling supplier. I’d test several manufacturers’ products and then stick with the winner for a year until the next round of testing. Sometimes this process would yield one manufacturer for metal-bond tooling and another for resin-bond products.

How long does the tooling last?

In addition to the cut, another telling factor is how long the tooling lasts. This is especially important in resin-bond diamonds. Simply put, each step should physically remove the scratches of the step before. A lot of resin manufacturers will cheat the system by lowering the amount of diamond in their higher-grit tooling and softening the resin itself. This leads to a false shine caused by melted resin sitting on the surface and filling the scratches from the step before rather than removing them. The industry commonly refers to this as “resin transfer.” It will significantly lower the life of the tooling.

This shine looks great at the time of completion, but doesn’t last long. The resin starts to come up with foot traffic and regular cleaning. If your resin diamonds aren’t lasting 10,000 square feet, this is an indication that you’re melting resin into the scratches and not physically removing the scratches. These diamonds are typically cheap so the contractor usually doesn’t pay as much attention to the rate of wear.

Indusrty Impact

In the long run, though, this practice is bad for the industry. Floors with a resin transfer polish don’t last as long and aren’t as easy to maintain. By lowering the life cycle, the cost valuation of polished concrete versus cheaper installation flooring types is not as good. Lower customer satisfaction from higher maintenance and lower floor life eventually leads customers away from polishing.

When I’m writing specifications, I try to stay on the safer path by selecting larger, well-known manufacturers. I assume they have more reputation and larger customer bases at stake so they spend more money and time ensuring they have high-quality tooling products. I test a lot of newer manufacturers and new products to try to determine the quality level and decide if my customers will be well served by allowing these tools into the specifications.

Preparation tooling

Finally, there’s a whole tooling subset based around floor preparation or removal of other flooring materials. There are tools that eat through VCT or epoxy coatings and tools made for taking large amounts of concrete off the surface. Manufacturers make these tools to fit plates that attach to concrete grinders.

The addition of these types of tooling has provided a wider range of available services using the same equipment. Contractors don’t have to buy as much specialty equipment to prep floors. In turn, I think this make it a welcome addition. In my opinion, the absolute best recent addition has to be “bush hammer” tooling. The speed at which these tools can remove surfaces has really changed the industry.

Saving money on the tooling price but adding labor costs to deal with the lower quality result is a losing proposition. You’re much better off to use higher-quality manufacturers and tooling and try to leverage the better results into lower project labor costs. Labor always has a higher cost than supplies. With a better understanding of the tooling available you can provide your customers with a better-quality product.

Author’s note: Several companies contributed photos and information for this article. A special thanks to Concrete Polishing Solutions, Diamatic and HTC for their support.